They have been shown to increase as much as 5% in the short span of only 3 years. Having a second party loan holder can be beneficial for some home buyers but can also make it hard to find everything you need in a mortgage.ĭisadvantages of adjustable rate mortgages: Most lenders opt to sell the mortgages to a secondary lender that does not allow the home to be financed on an individual basis.

Money can be saved during lower rate periods to prepare for the times when the rates are higher.If the current rates are lowered, the amount that is paid on the loan for that particular period is also lower. Give buyers financial freedom when there are lower interest rates available.Adjustable rates allow loan officers to quality people at a lower rate which will directly affect what they will be able to afford on paper. People are able to buy homes that they normally wouldn't be able to.

Since rates are lower, payments are also lower. The rates are often much lower in the beginning and begin to rise over time. With a fixed rate, there are no surprises. Even if there is a surge or crash in the economy, you can be sure that your mortgage payment will not change.

#20 year mortgage calculator how to

Since your monthly payment will not change, you will always know how to budget it in. This is also great for first time buyers or people who are new to maintaining a budget.

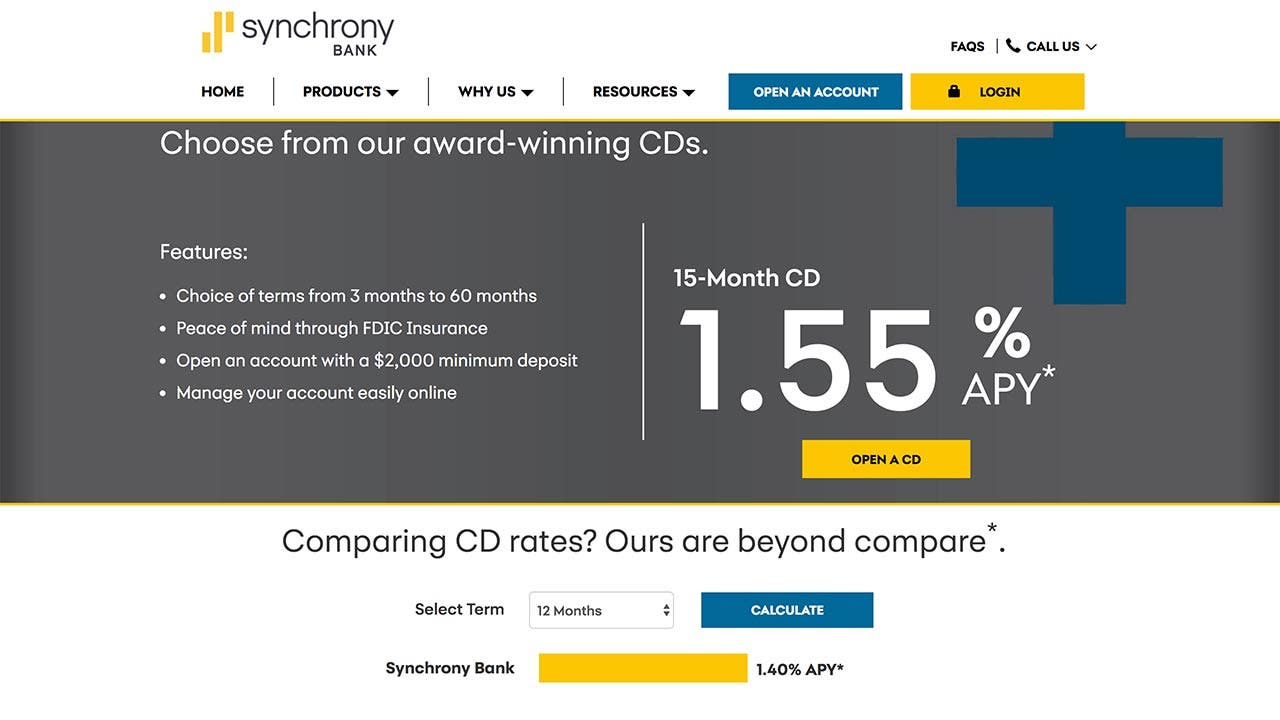

Fixed rate mortgages allow the buyer to have one interest rate throughout the entire term of their mortgage. Mortgages are not much different from other loans in this aspect. With any loan the two most popular terms that people will hear are fixed rate and adjustable rate. To mortgage a house, banks often require down payments that are around 10% of the total amount depending on your credit score, ability to repay and other important factors.The information below consists of the difference between fixed and adjustable rate mortgages, what mortgage rates are indexed to, the benefits and downsides to long or short term mortgages, how to prepare your finances to buy a home, how to successfully afford your mortgage, how often people move and have to switch mortgage terms around, incentives for buying, risks associated with home ownership and trivia facts that are focused on home mortgages. For the majority of Americans, a mortgage is the only option they have to their first home or any subsequent homes afterwards. (Almost) Everything You Should Know About Mortgage Ratesīuying a house is one of the biggest and most important decisions that a person can make in their lives.

0 kommentar(er)

0 kommentar(er)